SR&ED Meaning

Offered by the Canada Revenue Agency (CRA), the Scientific Research and Experimental Development (SR&ED) program is one of the largest tax incentive programs in Canada.

Since 1986, SR&ED has been supporting research and development for Canadian companies and each year the program provides over $3 billion in tax incentives to over 20,000 claimants each year.

SR&ED Objective

The objective of the SR&ED program is to encourage and support different types of companies to explore and experiment with the development of technology projects. The funding for the scientific and technological advances will not only keep the company competitive but also impel the patents within Canada, create more job opportunities and promote a healthy development and innovation of the entire industry.

SR&ED Eligibility: Qualified Projects

When you first heard about SR&ED, you may connect it with hi-tech companies. Its name always leads to confusion, but the program allows for many types of development and research that span a range of different kinds of businesses. Information technology, manufacturing, logistics, consulting, and real estate are just a few of the numerous ways a business can qualify for SR&ED.

However, the SR&ED program evaluates the eligibility according to the company’s project. Eligible work must fit under one of these three categories:

- Basic Research – work intended to advance scientific knowledge without aiming for a specific application;

- Applied Research – work intended to advance scientific knowledge while aiming for a specific application;

- Experimental Development (most common) – work intended to achieve technological advancement to create new or improve existing products or processes.

SR&ED Eligibility: Qualified Businesses

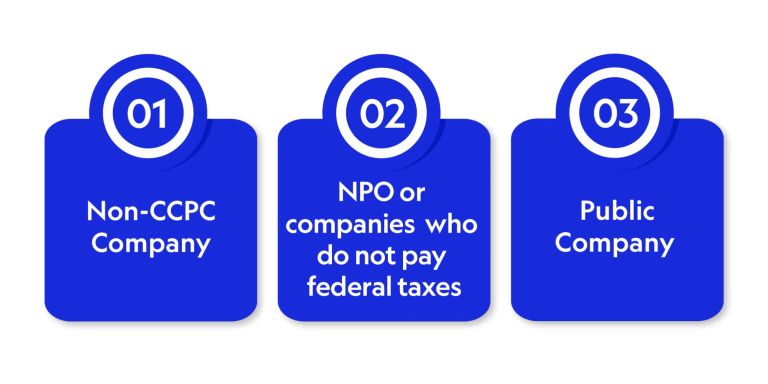

In addition to the specific demands of the projects, SR&ED also has some requirements for the companies. Companies that fit under one of these three categories are not recommended for SR&ED:

- Non-CCPC Company – a Canadian Controlled Private Company (CCPC) is a private corporation which is controlled by Canadian residents. A corporation will not qualify as a CCPC if it is controlled directly or indirectly by a public corporation or non-residents, or a combination of the two. Non-CCPC companies are not recommended to apply for SR&ED since this program is mainly to support Canadian businesses.

- NPO or Companies Who Do Not Pay Federal Taxes – A Non-Profit Organization (NPO) is a business that has been granted tax-exempt status because it furthers a social cause and provides a public benefit. Organizations or businesses who do not pay federal taxes could apply for other similar programs other than SR&ED.

- Public Company – A public company is a company whose shares trade on a stock exchange. Typically, public companies have sold shares to the public through an Initial Public Offering (IPO). There are other programs that are more suitable for public companies to apply for to improve their research and development.

SR&ED Application Process

After the application, companies will likely receive feedback from the CRA within 6-8 weeks. Based on the specific situation of the project, the CRA will determine if the claim can be processed. Companies may be contacted to provide supporting documents or receive the First-Time Claimant Advisory Service (FTCAS), and eligible businesses can get up to 64% of their eligible expenses refunded.

On the other hand, the SR&ED applicant may be asked for an SR&ED review. A successful SR&ED review will help to get the SR&ED tax credits. Well prepare the SR&ED documentations required by CRA is also important.

Are you interested in applying for SR&ED? The first-year application is of vital importance because it determines the process for the next few years, and that is the reason why you need to reach out to Requiti Capital’s skilled grant consultants. Subscribe to our blog and social media platforms for more information.