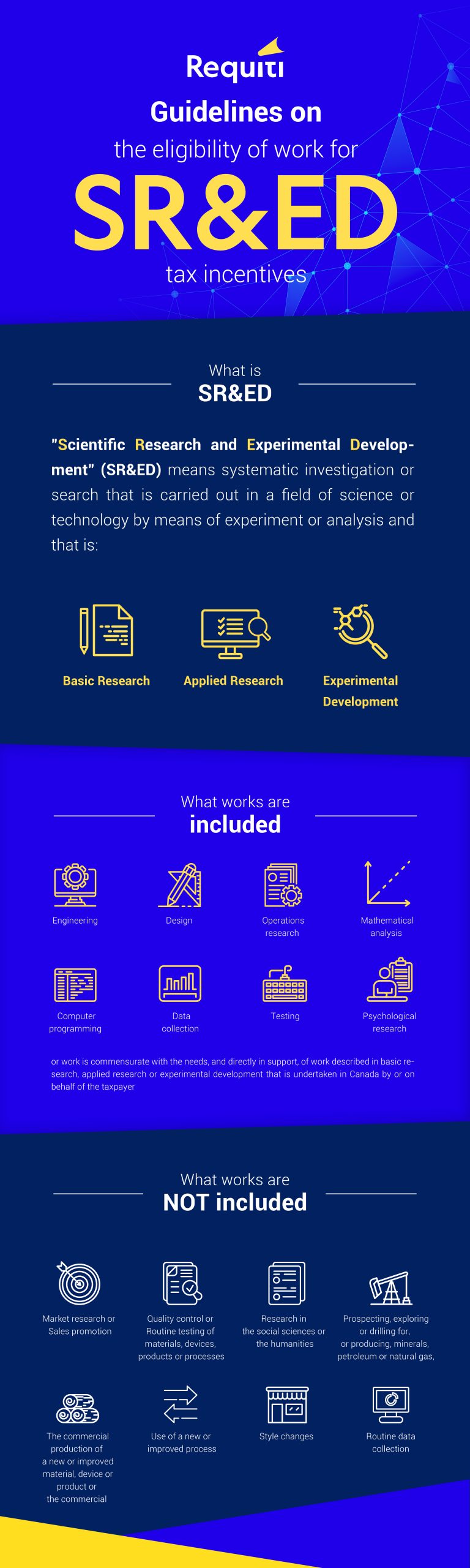

SR&ED Qualifications

If your research and development (R&D) project covers either of the following three categories:

- Basic Research

- Applied Research

- Experimental Development

Then congratulations! You are eligible to apply for SR&ED (Scientific Research and Experimental Development). However, there is one important question that you need to be clear about before the application: What are qualified expenditures can be claimed?

To get more information about: the types of spending, costs are allowed and the criteria to apply SR&ED, let us dive right into the qualified expenses for SR&ED.

Eligible: Direct Costs

Generally speaking, there are three types of direct costs that you can claim in your SR&ED application:

Salaries and Wages

Salaries and wages that you have paid for your employees during the project can be claimed as qualified expenditures for SR&ED. In order to calculate the qualified salary and wage for a SR&ED employee, you need to know his/her hourly rate and the total eligible SR&ED hours. Remember, the hours that were off – including holidays, vacations and sick leaves – need to be excluded.

Materials

A number of materials will be used when you are conducting the SR&ED project, and claiming the cost of them can maximize your SR&ED tax credit. Make sure you keep all the invoices, proof of payments and shipping documents safe. In most cases, there are two types of material expenditures for SR&ED:

- Transformed Materials – Materials that have been changed into another material or product during the SR&ED project.

- Consumed Materials – Materials that have been destroyed by tests and experiments during the SR&ED project.

Third-Party Payments

If you have to pay a subcontractor to perform work related to SR&ED activities, those expenses can be considered deductible, but they have to respect the following rules:

- Supervision – there must be some R&D taking place under the supervision of your contractors.

- Relevance – The R&D needs to be closely related to your SR&ED project.

- Benefit – The R&D needs to have a direct and beneficial application to your SR&ED project.

Eligible: Indirect Cost (Overhead Cost)

Indirect costs – also known as overhead costs refer to the expenses not directly related to your SR&ED project but are necessary to support the business. For example, the maintenance of your equipment has no direct connection with your SR&ED project, but the project cannot complete if your equipment fails during the R&D process. Indirect costs can be calculated and claimed through either of the following methods:

Traditional Method

If your company is well-organized and prefers to keep records regularly, the traditional method is for you. All you need to do is fill up Form T661 and let the CRA identify if all the expenses are eligible for SR&ED. This is helpful if you want to receive the most accurate tax credit according to your project.

Prescribed Proxy Method

However, if you think the traditional method is too complicated and time-consuming, there is also a proxy method. It is simpler because you only need to determine the amount of eligible salary and wage expenditures for your SR&ED project. The indirect costs will be a percentage of that total. In addition to requiring less-detailed records, this method can also be beneficial as the estimated total is typically more than the actual sum of the indirect costs.

Ineligible Expenditures

Expenses that are not supporting your R&D are ineligible for SR&ED. CRA lists examples of ineligible expenditures include (but are not limited to):

- Sales and marketing

- Commercial production of a new or improved product

- Routine testing and maintenance

- Routine data collection

- Updates to a product’s style

- Research in social sciences or the humanities

- Prospecting, exploring or drilling for minerals, petroleum or natural gas

Summary

As mentioned in the “Application Process” in SR&ED Overview, once you complete the SR&ED application with eligible expenses recorded, you will likely receive feedback from the CRA within 6-8 weeks.

Based on the specific situation of the project, the CRA will determine if the claim can be processed. You may be contacted to provide supporting documents or receive the First-Time Claimant Advisory Service (FTCAS), and about 60% of your eligible expenses will be refunded according to the different percentages in each province.

SR&ED Application: Review Documents and Evaluate Eligible Expenses

Both evaluating the expenses to be claimed and reviewing the documents for SR&ED application are meaningful. It will give you a whole picture and even more information about your application, such as: How many returns and credits can you get from the SR&ED program? What to expect about the application and future fiscal years?

A professional SR&ED consultant team will help to provide detailed information and answer your questions about the SR&ED program.

Simply tell your background and start to schedule a complimentary (free) session with the SR&ED experts from us.