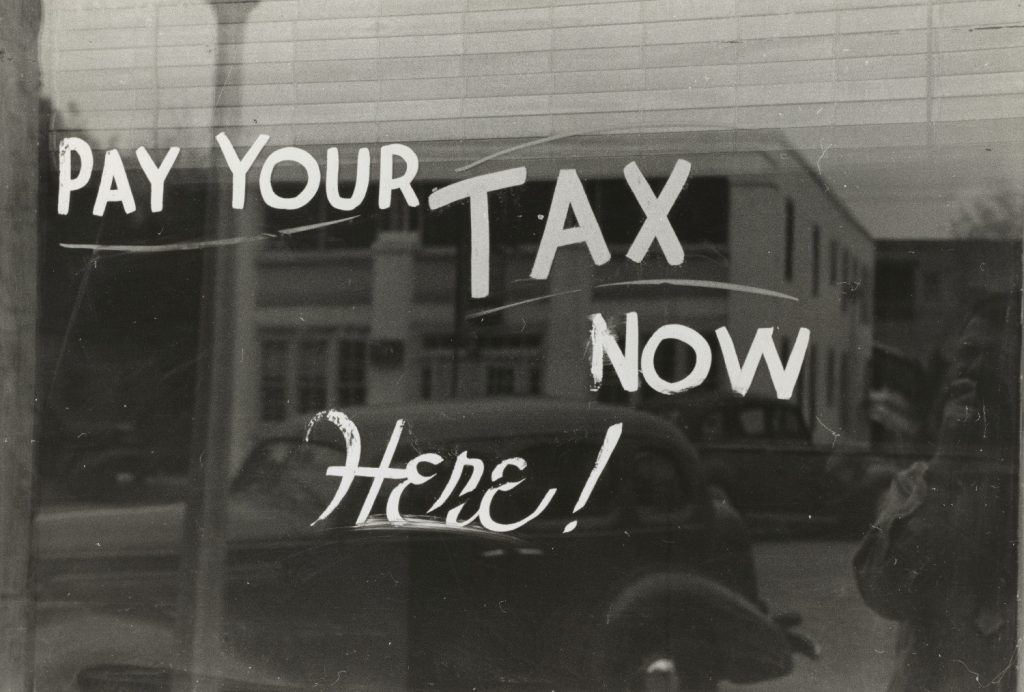

How architects can take advantage of R&D tax incentives

New buildings constructed using innovative techniques are springing up all over Canada. These structures only exist because someone tried to push the boundaries of what was possible — and quite often it’s an architect who was responsible. But what many architects don’t realize is that tax benefits exist for all kinds of innovation through the […]

SR&ED payments beginning to flow to Canadian tech following delay caused by COVID-19

Funds from the federal government’s Scientific Research and Experimental Development (SR&ED) tax incentive program that have not been released due to the COVID-19 pandemic are now starting to flow. “It might just buy them enough time for the federal government to get the 75 percent wage subsidy right.” The COVID-19 crisis reportedly delayed nearly $200 […]

CRA Operational Update: Ten Things You Need To Know – Tax

On June 23, two senior Canada Revenue Agency (“CRA“) officials outlined a status update on tax controversy and dispute resolution at this stage of the COVID-19 pandemic. This previewed the CRA’s progression from “critical services” mode, to a “business continuity” plan and finally to a “business resumption” plan starting June 29. As the presentation was […]