The government grant landscape is changing; how does IT fit in?

Over the last two years, the federal government has introduced many new incentives for research and development, mainly by way of grants or non-repayable contributions.

Unleash your business potential.

Scientific Research and Experimental Development

Eligible Business Corporation Tax Credit

Future-proof your business without breaking the bank

Interactive Digital Media Tax Credit

Drive value creation with an expert team at your side.

Maximizes companies’ true value by unlocking their hidden potential.

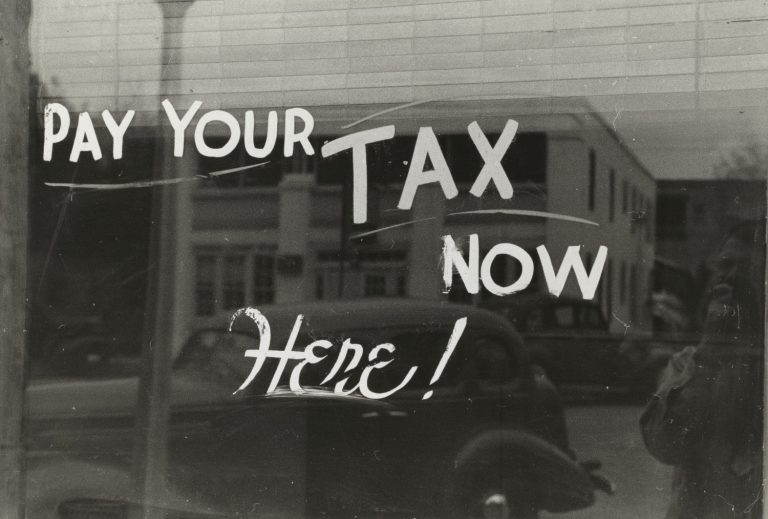

All about funding, tax credits and how to grow your business.

The newest developments on tax credits at your fingertips.

Calculate how much you can claim from SR&ED

Get answers to your most common questions.

Over the last two years, the federal government has introduced many new incentives for research and development, mainly by way of grants or non-repayable contributions.

That didn’t take long. Less than a week after the Canadian Advanced Technology Alliance (CATA) officially released a report breaking down how the federal government

Several industries have already faced the brunt of the ongoing COVID-19 crisis, with the SRED tax credit industry being no exception. This pandemic has created

On Friday, Prime Minister Justin Trudeau announced that the federal government will now be providing 75 percent employees wage subsidies for qualifying small-and-medium-sized enterprises (SMEs).

The National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) and Innovate BC have signed a memorandum of understanding (MOU) to invest more

In 2019, I wrote an article on how the CRA had become tougher on SR&ED claims despite the declining number of reviews. However, the latest

For its part, the Canada Revenue Agency says ‘non-critical services’ such as the SR&ED program have had to take a backseat while the agency adds

If you’re a Canadian tech company, listen up: there are billions of government dollars available to you, and chances are, you’re not yet taking advantage

New buildings constructed using innovative techniques are springing up all over Canada. These structures only exist because someone tried to push the boundaries of what

On June 23, two senior Canada Revenue Agency (“CRA“) officials outlined a status update on tax controversy and dispute resolution at this stage of the

The Canada Revenue Agency won’t launch any new audits under a tax-credit program that has seen nearly $200 million in funding for tech companies delayed

A week ago, CEO of Venbridge Garron Helman wrote an article on how the recent government incentive programs could affect SR&ED claims. For weeks now

Our team is ready to show how we can help your business get the tax credits it deserves.